Hanesbrands: Reducing Inventory Is The Key To A Turnaround (NYSE

By A Mystery Man Writer

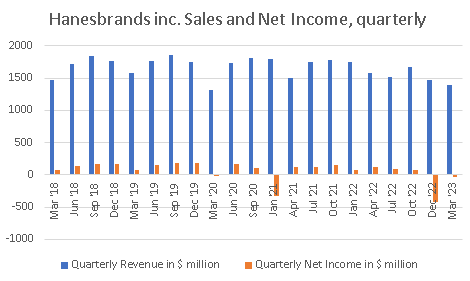

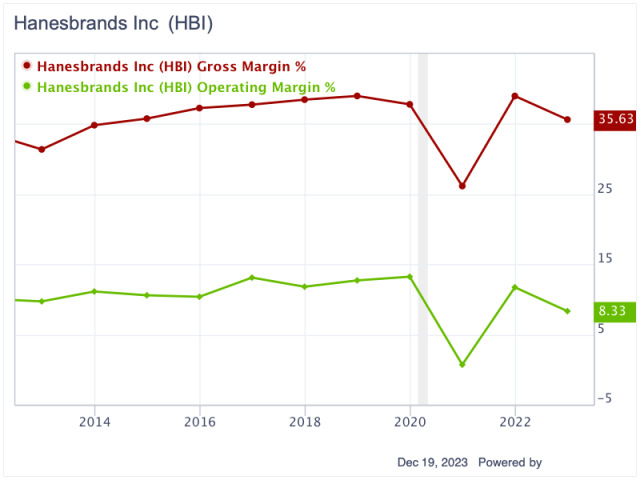

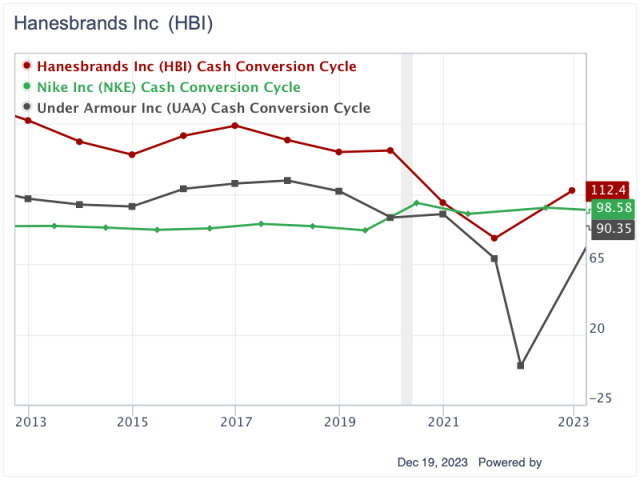

Hanesbrands' priority is to reduce inventory which will help its gross margins and debt issues. Click here to see why HBI stock is a Buy.

Hanesbrands' priority is to reduce inventory which will help its gross margins and debt issues. Click here to see why HBI stock is a Buy.

Hanesbrands Inc. (NYSE:HBI) to Post Q1 2024 Earnings of ($0.06) Per Share, Zacks Research Forecasts - Defense World

Should Value Investors Pick Hanesbrands (HBI) Stock Now?

Hanesbrands: No Signs Of Recovery Just Yet

Hanesbrands: No Signs Of Recovery Just Yet

Further weakness as Hanesbrands (NYSE:HBI) drops 11% this week, taking five-year losses to 76%

Why Hanesbrands Stock Is Sinking This Week

Why Hanesbrands Stock Is Sinking This Week

Hanesbrands Loses 10% in a Year: Rising Costs a Key Concern

Hanesbrands: Temporary Headwinds, Long-Term Value (NYSE:HBI)

Hanesbrands Has Upside Potential in Its Deleveraging Journey

HBI -- Is Its Stock Price A Worthy Investment? Learn More.

HBI -- Is Its Stock Price A Worthy Investment? Learn More.

Hanesbrands: Turnaround Opportunity For This Extremely Undervalued Stock ( NYSE:HBI)

Hanesbrands Has Upside Potential in Its Deleveraging Journey

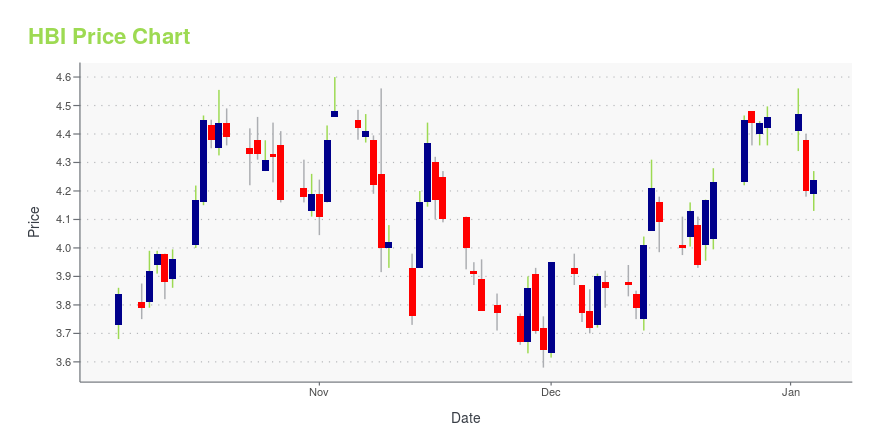

HBI - Hanesbrands Inc Stock Price and Quote

- Hanes 4980 4.5 Oz. Perfect T Short Sleeve Tee

- Hanes Promotes Male Body Positivity With Musical 'Every Bod' Campaign

- Wanna Pile on 25 lbs. of Muscle for the Mountains? – Cameron Hanes

- Hanes, Accessories, Hanes Body Shaper Silky Sheer Pantyhose Nude Size Q

- Hanesbrands: Reducing Inventory Is The Key To A Turnaround (NYSE:HBI)

- BELLZELY Underwear Women Pack Cotton Clearance Women's Stretch

- NKOOGH Preppy Outfits Girls Sweat Outfits Baby Girl Summer Clothes Outfit Solid Sleeveless Top Elastic Short Pants Short Set 2Pcs

- Conjunto fitness liso poliamida feminino detalhes acadêmia - TRENDY FASHION - Conjunto de Roupa Fitness - Magazine Luiza

- Vestido sexy con correas ahuecadas para mujer, vestido de cadera

- Bra Pattern, Judy Partial Bra Pattern