What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips

By A Mystery Man Writer

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

Are GI Benefits Considered Income On Your Tax Return?, 42% OFF

2012 TurboTax Home & Business Federal Taxes Turbo Tax New sealed CD in sleeve – Contino

Taxes 2006 For Dummies (Taxes for Dummies) 0471747556, 9780471747550, 9780471793403

Rules For Claiming A Dependent On Your Tax Return TurboTax, 53% OFF

Are GI Benefits Considered Income On Your Tax Return?, 42% OFF

Turbotax Business 2022, Federal Return Only [PC Download] – TaxPrepWarehouse

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 58% OFF

TurboTax Live Assisted - Premier 2022-2023

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 55% OFF

- Basic Facts about Low-Income Children: Children under 18 Years

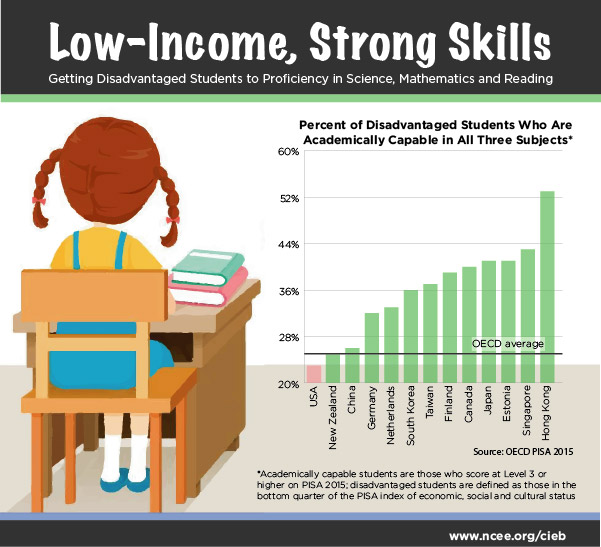

- Low-Income, Strong Skills - NCEE

- Living on a Low Income: Guide to Resources & Support

- How to Reduce Inflation-induced Costs for Low-income Families - Route Fifty

- Inflation Experiences for Lower and Higher Income Households : Spotlight on Statistics: U.S. Bureau of Labor Statistics

- tmp

- Cacique Unlined Full Coverage Bra 38DDD Black Subtle Sateen Sheen Underwire Size 38 F / DDD - $11 - From Ksenia

- Water Bottles 1 Litre Sipper Bottle For Adults Kids Boys Girls Water Bottle 1 Litre Motivational Water Bottle Sipper With Straw & Time For Gym Office School Home Water bottle for kids

- Uncle Tobys Cheerios Honey

- 2020 BRANDON AIYUK GOES AIRBORNE FOR TOUCHDOWN PANINI INSTANT 49ers NFL CARD #60