Section 2(11) Income Tax: Block of Assets - Meaning & Concept

By A Mystery Man Writer

Section 2(11) of Income Tax defines 'Block of Assets' as a 'group of assets' in respect of which the same percentage of depreciation is to be applied

What is Previous Year in Income Tax under Section 3?

What Does a Financial Advisor Do? Definition and Examples

Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Form W-2 Box 12 Codes Codes and Explanations [Chart]

/content/dam/pwc-madison/ditaroot

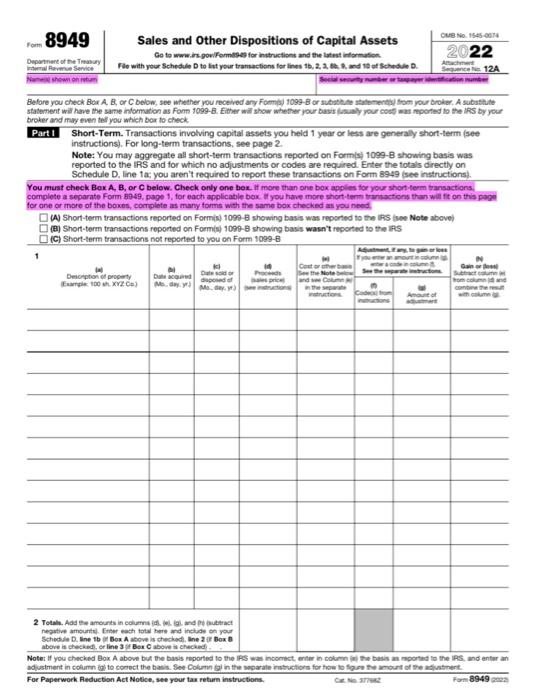

You will be preparing a 2022 personal income tax

Income From Capital Gains - Capital Gain Tax

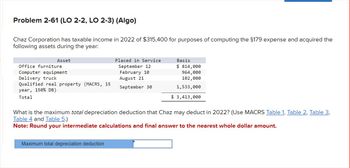

Answered: Problem 2-61 (LO 2-2, LO 2-3) (Algo)…

Why do we have a concept like block of assets for charging depreciation in the income tax act of 1961? What were the lawmakers thinking? - Quora

8 ways to calculate depreciation in Excel - Journal of Accountancy

Good Intentions, Perverse Outcomes: The Impact of Impact Investing!

Unabsorbed Depreciation Set Off & Carry Forward - Section 32(2)

Form 4562: A Simple Guide to the IRS Depreciation Form