IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

By A Mystery Man Writer

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099-A: Acquisition or Abandonment of Secured Property

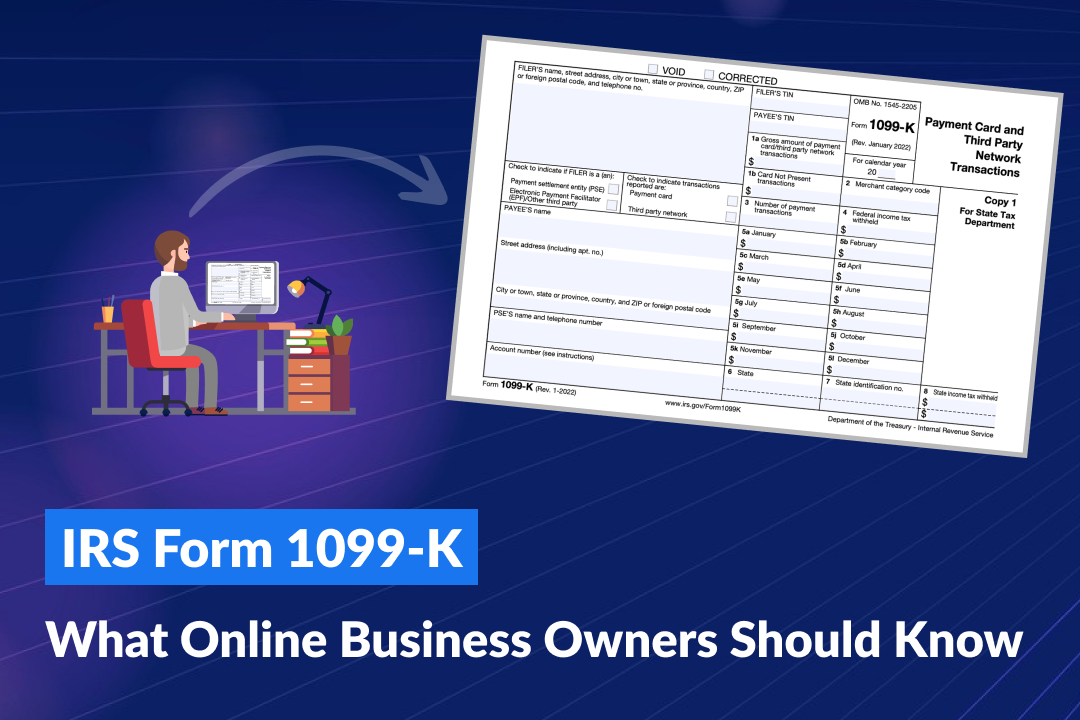

IRS Form 1099-K: What Online Business Owners Should Know

What Is the IRS Form 1099-MISC? - TurboTax Tax Tips & Videos

Dual Nationality TAx Report - Koinly Support - Koinly

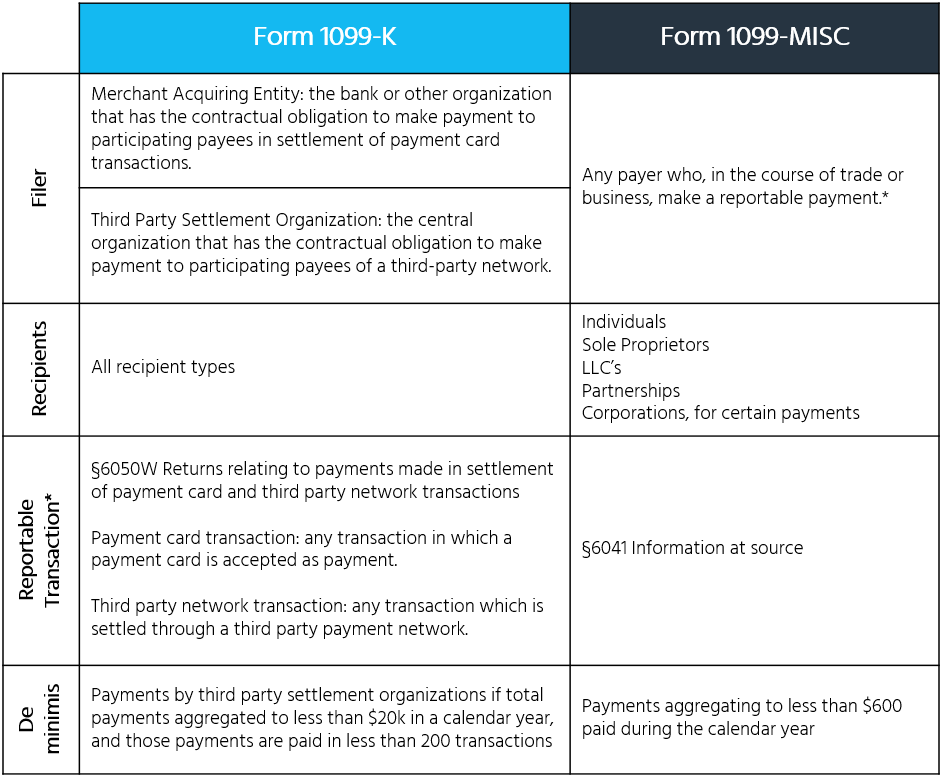

IRS Forms 1099-MISC vs. 1099-K: States Close Tax Reporting Gap

Quick Guide To Filing Your 2021 Cryptocurrency & NFT Taxes

Will Binance.US send a 1099? - Quora

Form 1099-MISC vs. 1099-NEC Differences, Deadlines, & More

Planning Your Crypto Taxes? 1099-K or 1099-B, What Should You Expect from Exchanges?

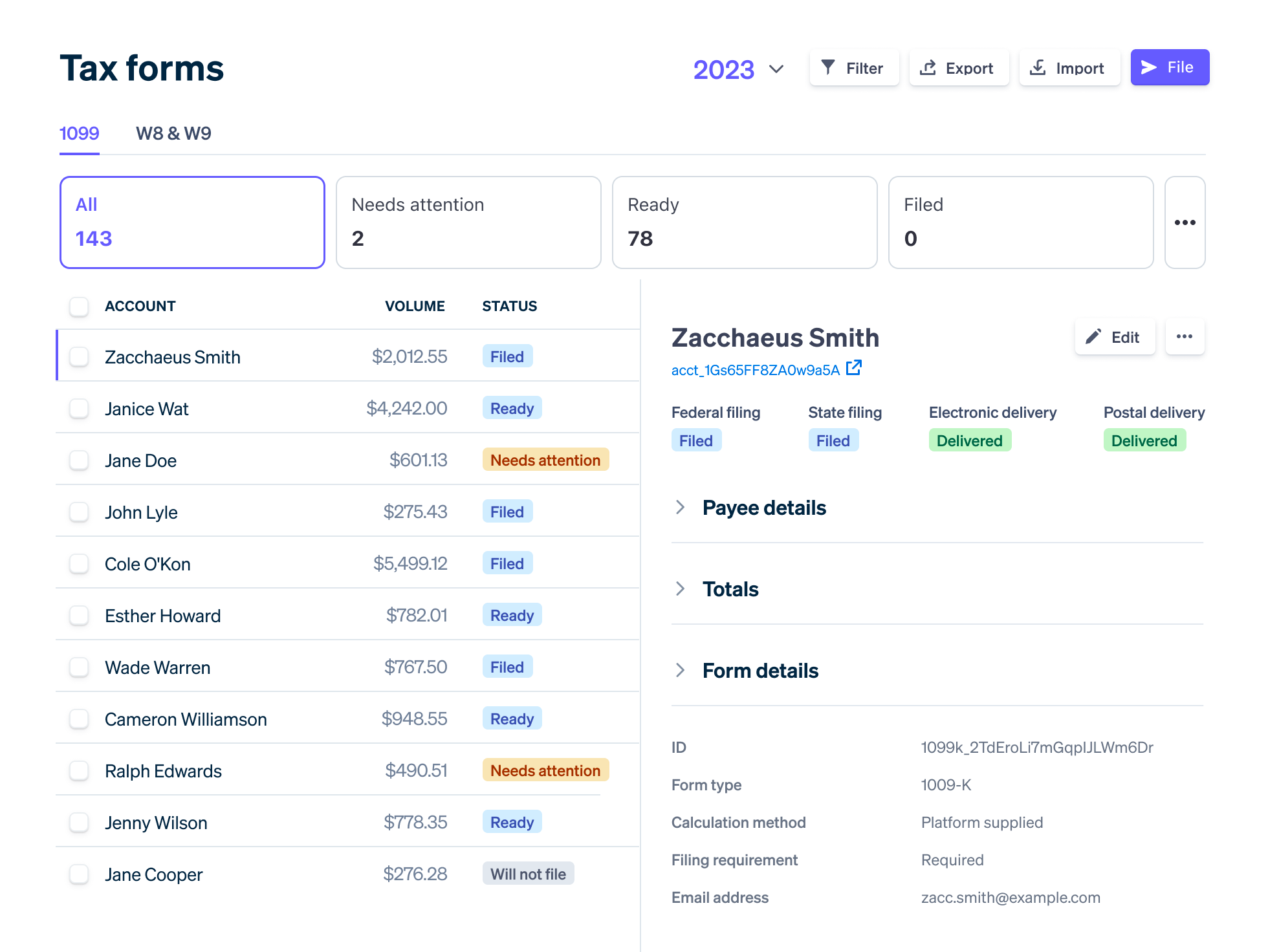

Stripe Connect: 1099

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

What Are 10 Things You Should Know About 1099s?

- Livi Active, Intimates & Sleepwear, Lane Bryant Livi Active High Impact Moisture Wicking Max Support Sports Bra 46d

- Apollon Gym

- Tops Filler Paper, 3-Hole, 5.5 x 8.5, Medium/college Rule, 100/Pack | Bundle of 5 Packs

- Cuándo termina Mujer? Antena 3 alarga el final de la serie cortando su último capítulo

- Umhlobo Wenene mourns the passing of two radio legends