Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

By A Mystery Man Writer

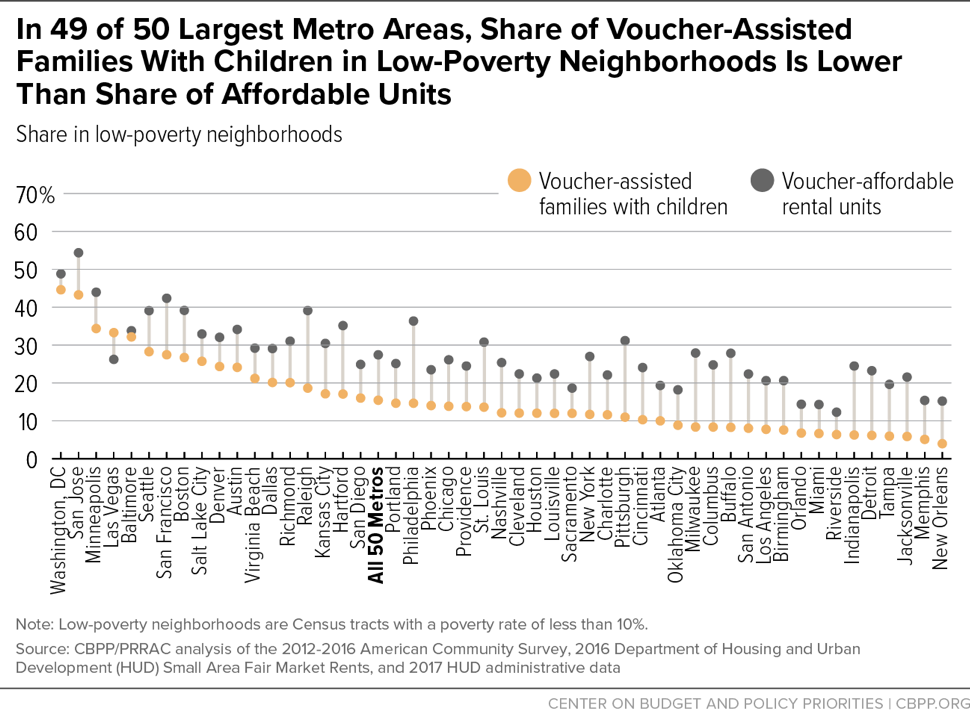

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24468051/1244775498.jpg)

It's time for Biden to prioritize the affordable housing shortage - Vox

Low-Income Housing Tax Credit: Opportunities to Improve Oversight

Can I get low income housing with an eviction

The Low Income Housing Tax Credit - PRRAC — Connecting Research to

/cdn.vox-cdn.com/uploads/chorus_image/image/70875364/untitled_shoot_0628.0.jpg)

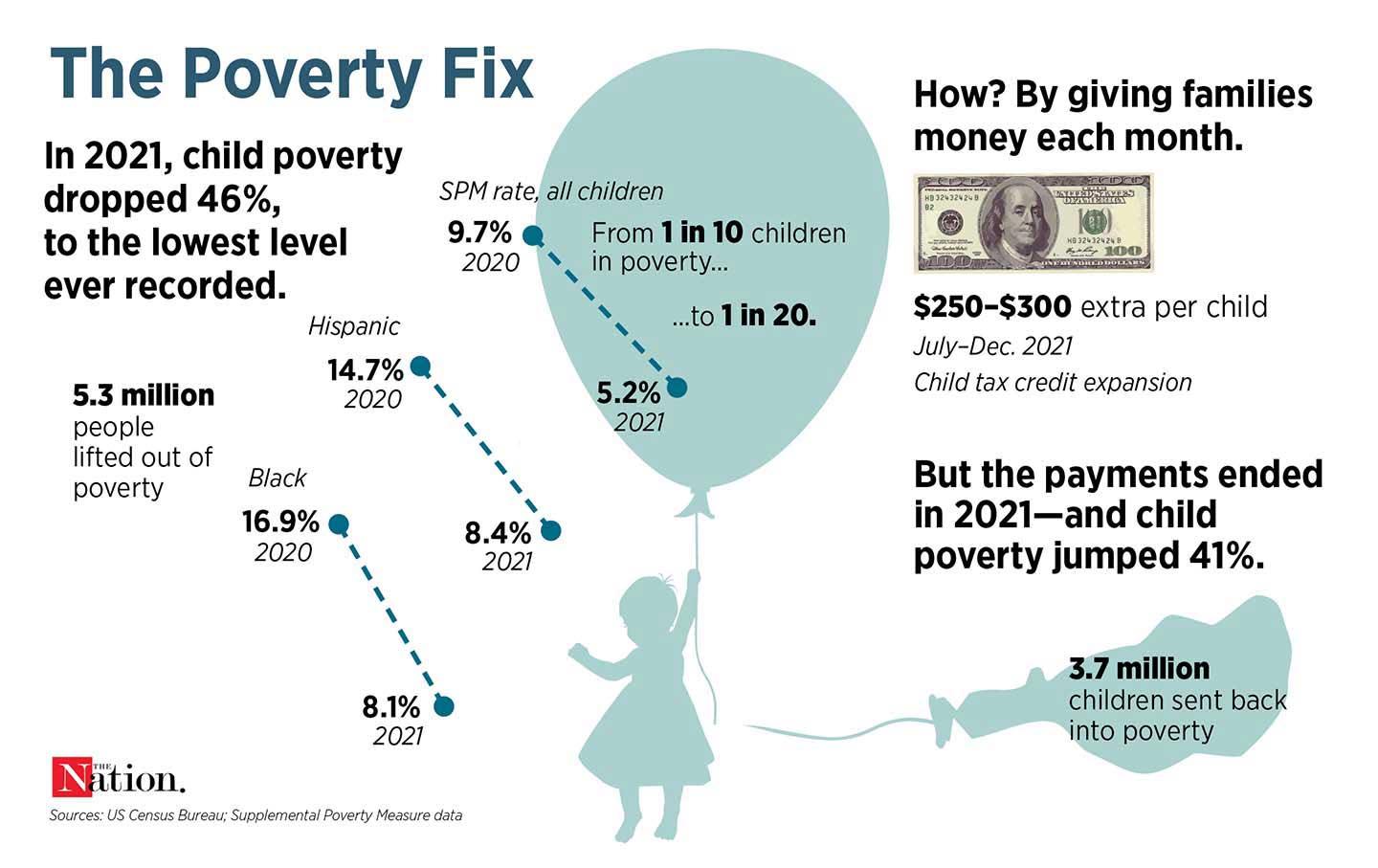

The expanded child tax credit lifted 3 million children out of

We Have the Solution to Child Poverty. Republicans Are Blocking It.

Millions of kids were thrust back into poverty after the child tax credit expired. What's next?

The New Social Housing - Harvard Design Magazine

Where Families With Children Use Housing Vouchers

Equity and Climate for Homes - Circulate San Diego - Staging

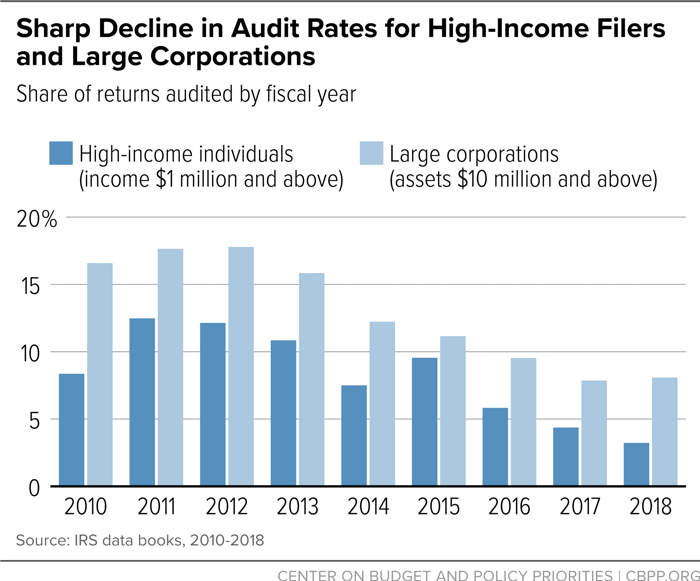

How the Federal Tax Code Can Better Advance Racial Equity

The Fight to Expand the Low-income Housing Tax Credit - Route Fifty

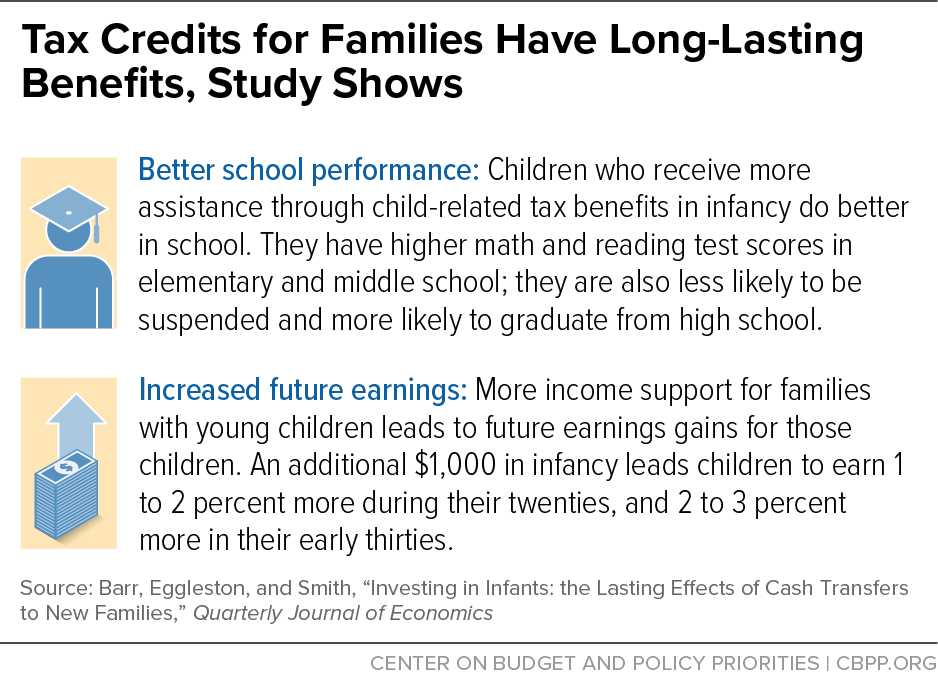

New Study Finds Income Support in Childhood Increases Future Earnings

Subsidized housing in the United States - Wikipedia

- New Jersey Department of Community Affairs (DCA)

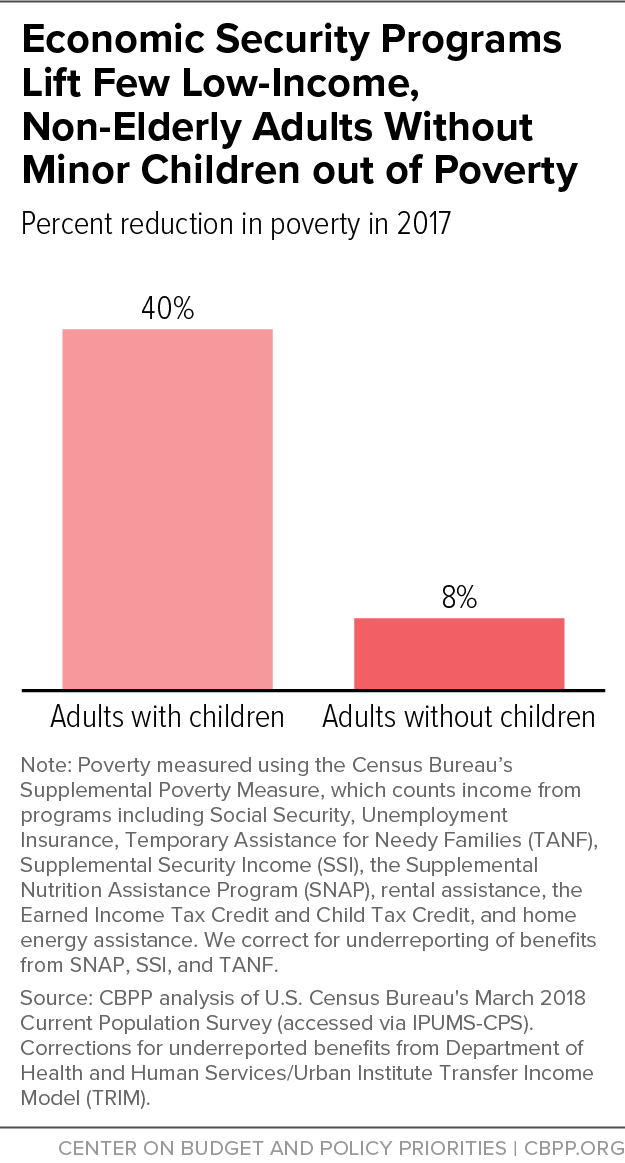

- A Frayed and Fragmented System of Supports for Low-Income Adults

- Chronic Low Income Among Immigrants in Canada and its Communities

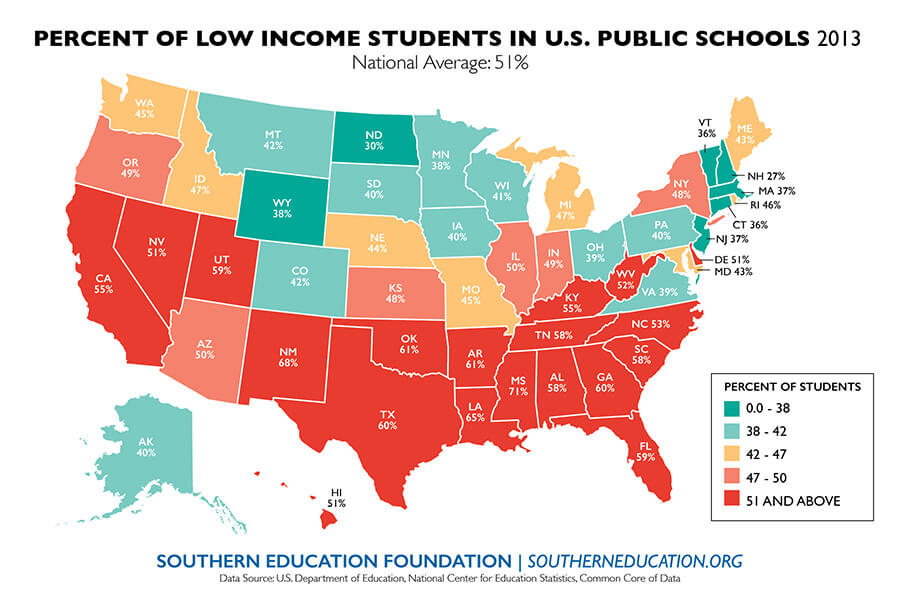

- Majority of Nation's Public School Students Now Low-Income - Southern Spaces

- LIHTC for Regular People — Shelterforce Shelterforce