Carry and Roll-Down on a Yield Curve using R code

By A Mystery Man Writer

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

Applied Sciences, Free Full-Text

R code snippet : Transform from long format to wide format

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

Mastering Carry Roll-Down with Leverage, by Secured Finance Official, Secured Finance

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Roll down yield on upwards sloping YC : r/CFA

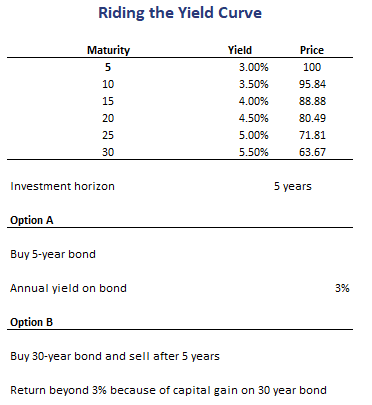

🔴Riding the Yield Curve or Rolling down the yield curve simplified

Riding the yield curve – BSIC Bocconi Students Investment Club

Yield to Maturity and Reinvestment Risk

R code snippet : Transform from long format to wide format

Fixed income: Carry roll down (FRM T4-31)

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

Riding the Yield Curve - Breaking Down Finance

:max_bytes(150000):strip_icc()/InvertedYieldCurve3-a2dd4a71cac949d6bd03c2bca892e683.png)

The Impact of an Inverted Yield Curve

- Liposucción de Papada en Tijuana - Dr. Jorge Rodríguez Cisneros

- SHAPERMINT Compression Leggings For Women - Tummy Control Leggings For Women - Black Leggings Women - Womens Leggings - High Waisted Leggings - Black Leggings Tummy Control

- Free Photo Sport outdoor, girl jogging, girl jogging

- How Much is Body Liposuction in Canada?

- Chrome Hearts Black Horseshoe Logo Tank top Dress - SRM – SHENGLI ROAD MARKET