Japan's Experience with Yield Curve Control - Liberty Street Economics

By A Mystery Man Writer

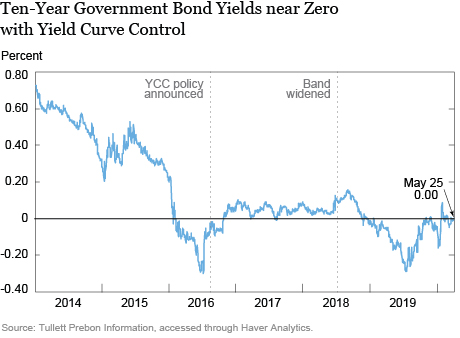

In September 2016, the Bank of Japan (BoJ) changed its policy framework to target the yield on ten-year government bonds at “around zero percent,” close to the prevailing rate at the time. The new framework was announced as a modification of the Bank's earlier policy of rapid monetary base expansion via large-scale asset purchases—a policy that market participants increasingly regarded as unsustainable. While the BoJ announced that the rapid pace of government bond purchases would not change, it turned out that the yield target approach allowed for a dramatic scaling back in purchases. In Japan’s case, the commitment to purchase whatever was needed to keep the ten-year rate near zero has meant that very little in the way of asset purchases have been required.

How Bank Of Japan's Yield Curve Control Policy Shift Is Rattling Global Markets - Doo Prime News

CNBC explains: The Bank of Japan 'yield curve control

Yield curve control - Wikipedia

Short-Term Treasury Market Walks Away from Rate-Cut Mania, Inflation Has Upper Hand

Impact of Yield Curve Control Change on Stock Prices – What Industries Are Positively or Negatively Affected? - 株式会社QUICK:Our Knowledge, Your Value.

Japanese government bond (JGB) yield curve.

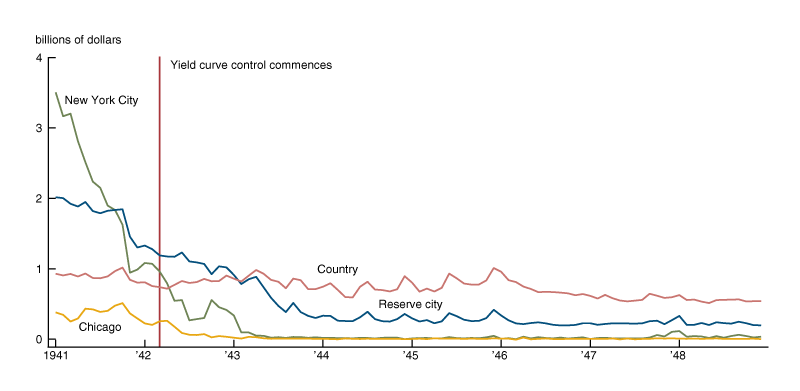

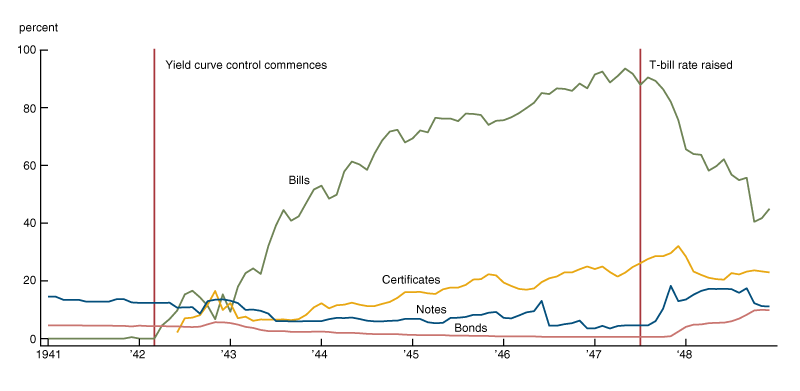

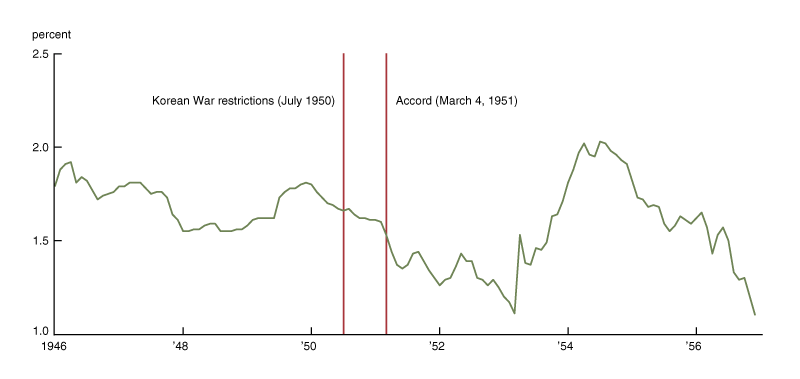

Yield Curve Control In The United States, 1942 to 1951 - Federal Reserve Bank of Chicago

How does Japan's yield curve control work?

What BOJ Ending Yield-Curve Control Could Mean for Global Bonds and Japanese Equities - CME Group

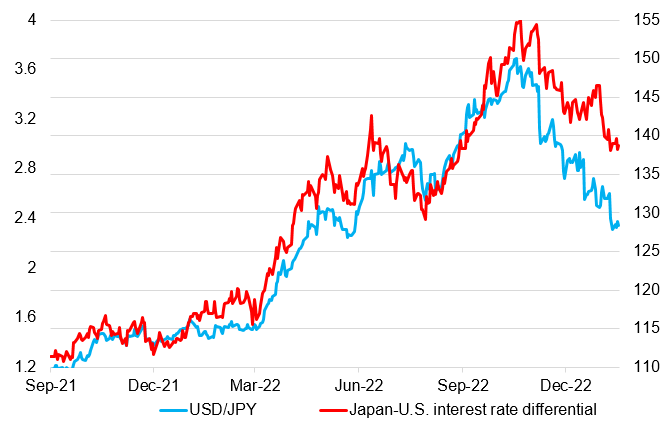

The global implications for a shift in Japan's yield curve control

Are Negative Rates a Natural Historical Development?

Yield Curve Control In The United States, 1942 to 1951 - Federal Reserve Bank of Chicago

Yield Curve Control In The United States, 1942 to 1951 - Federal Reserve Bank of Chicago

Japan: Yield curve out of control?

- Short Film Review: Curve: Minimalist Horror Straight Out Of Nightmares - Indie Shorts Mag

- Curve (2016) Movie Review #shortfilm #horror #moviereview

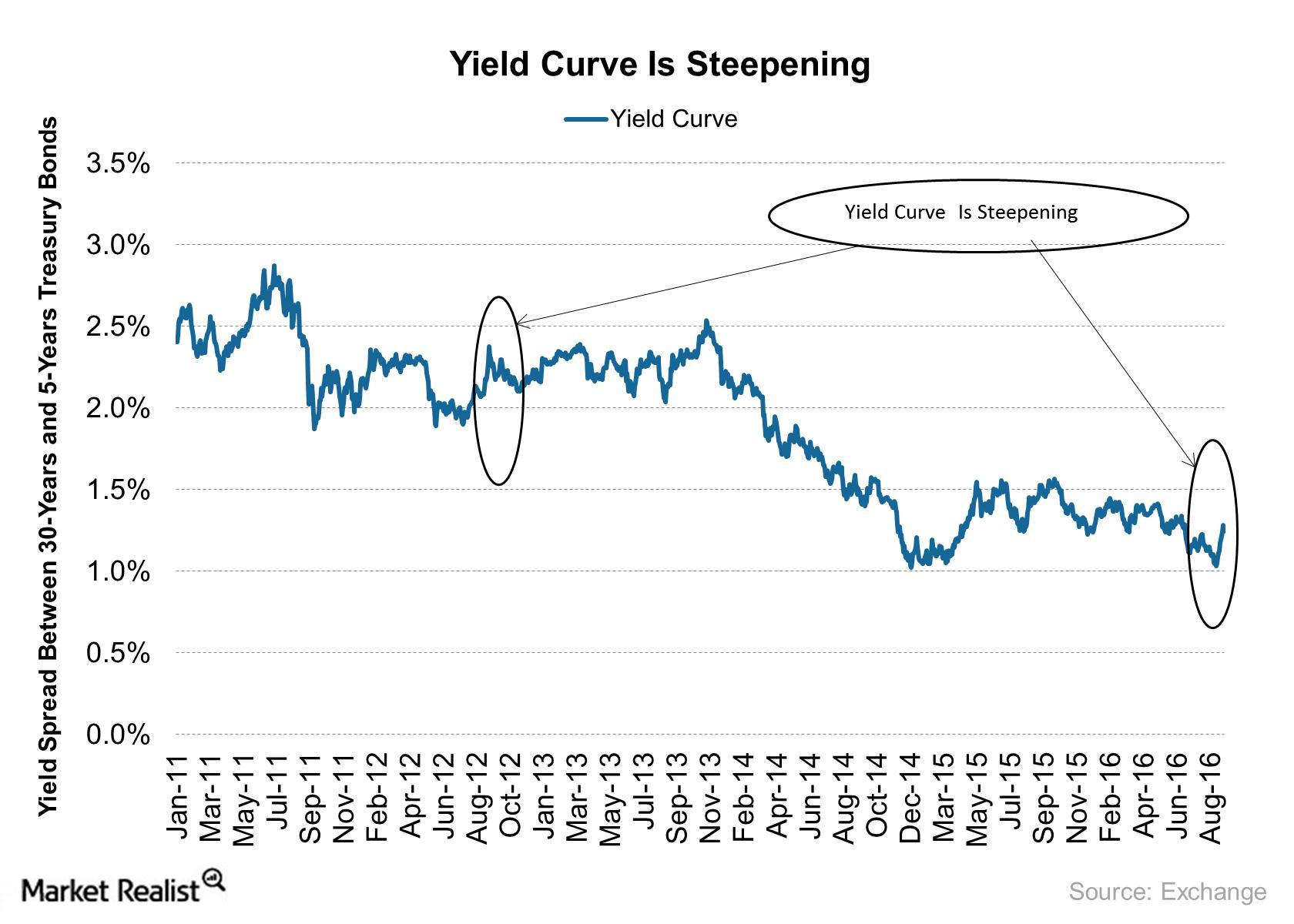

- The Yield Curve: What You've Always Wanted to Know but Were Afraid to Ask - Derivative Logic

- Yield Curve Is Steepening: What Does It Indicate for the Market?

- 2016 CUBE curve Pro – Specs, Comparisons, Reviews – 99 Spokes

- Customised Medical Rehabilitation Adjustable Finger Tendonitis

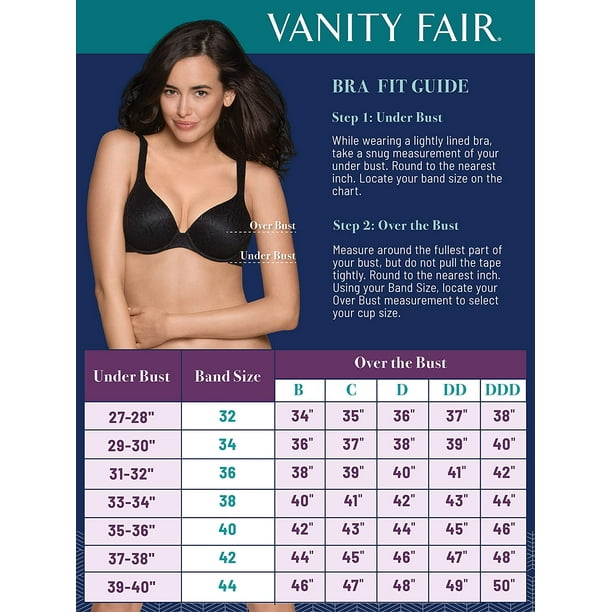

- Vanity Fair Womens Beauty Back Smoothing Seamless T-Shirt Bra

- Women's High Waisted Gym Leggings – J.LUXE.FIT

- AURORA FIT BODY BOOT CAMP - 7-255 Industrial Parkway S, Aurora, Ontario - Trainers - Phone Number - Yelp

- Keep It Neutral - Trendy Curvy Plus size fashion, Curvy girl