Millennial Money: Navigating the SSI 'marriage penalty', National

By A Mystery Man Writer

For people who rely on Supplemental Security Income, or SSI, getting married can result in reduced monthly benefits and a lower amount allowed for savings. Individual SSI recipients can own up to $2,000 in resources, while couples can have a combined $3,000. Though these limits can dissuade some couples from marrying, exemptions for assets such as primary residences and wedding rings can help bypass these kinds of restrictions. Social Security programs such as Plan to Achieve Self-Support and Achieving a Better Life Experience also offer flexible savings avenues.

Millennial Money: Navigating the SSI 'marriage penalty

Bechtel's $7 million dollar commitment to the American Foundation for Suicide Prevention will provide critical resources and programming to 500,000 U.S. construction workers over the next five years. – Mecklenburg Times: News

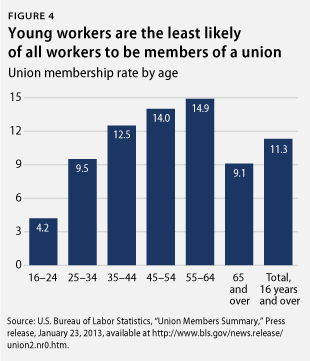

Promoting Good Jobs for Millennials - Center for American Progress

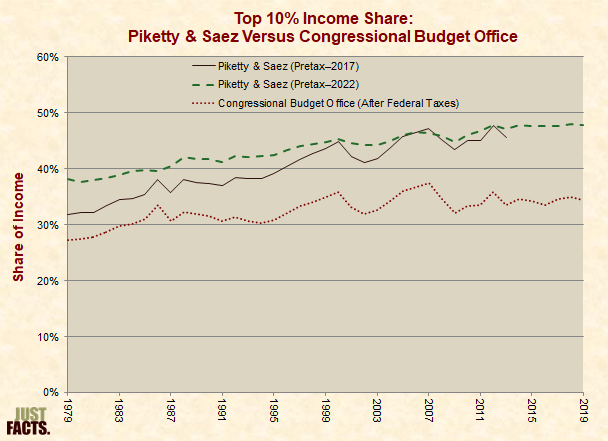

Income, Wealth, and Poverty – Just Facts

What to know before you vote in Ohio primary

Millennials say their financial situation is dire

March Madness: Top seed UConn cruises past Northwestern in title defense

DALIA RAMIREZ of NerdWallet

CNN's new chief says the network needs to recapture the “swagger and innovation” of its youth – Winnipeg Free Press

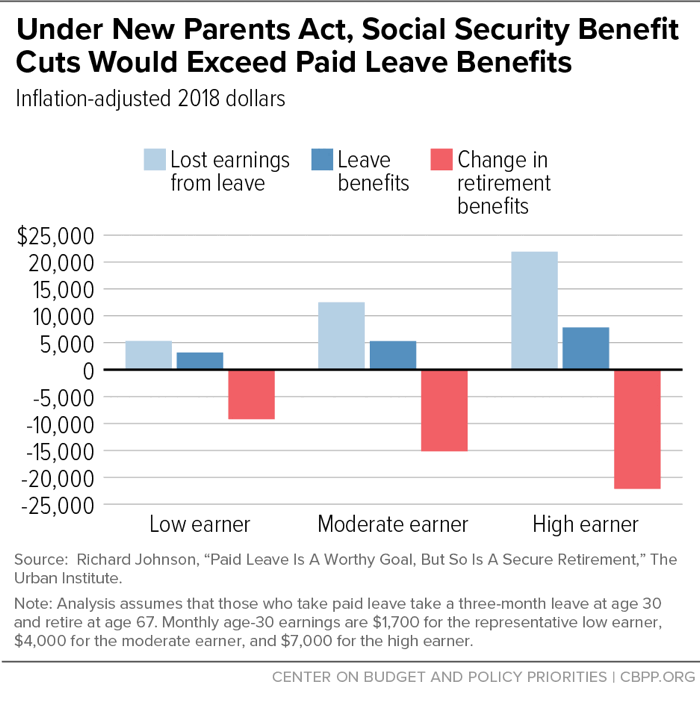

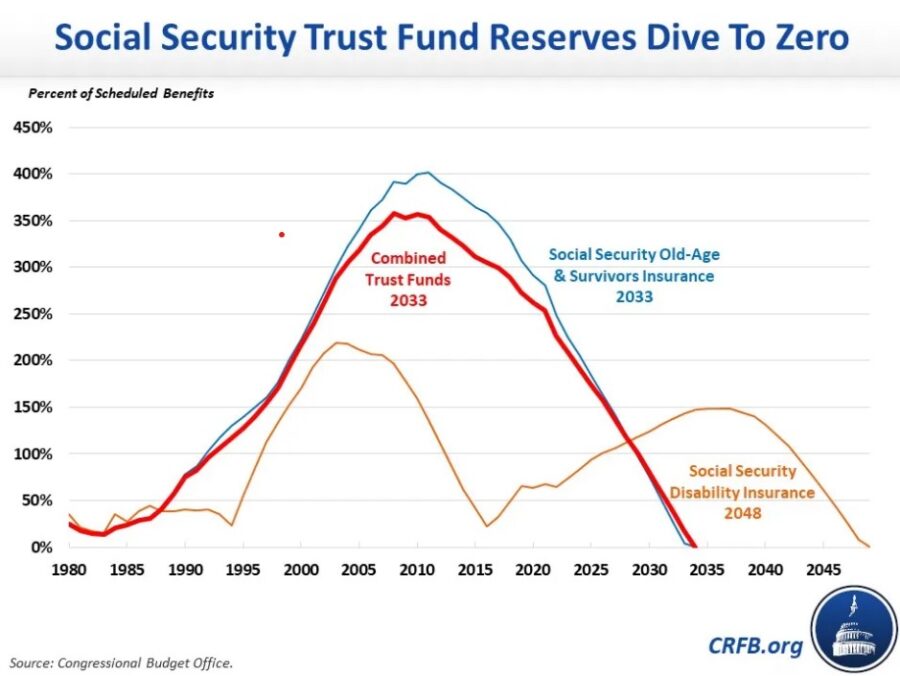

Cutting Social Security to Offset Paid Parental Leave Would Weaken Retirement Security

Third rail' heats up as Social Security reform talk increases

Taxation « William Byrnes' Tax, Wealth, and Risk Intelligence

Millennial Money: Navigating the SSI 'marriage penalty

- Punishment Bra

- The Tights Club - Vlad the impaler, the punishment for delaying the washing for that bit too long 🔪

- Sexual experienced brunette dominant woman in leather cat mask, practices bdsm with partner, wears lace bra, ready for adult sexual games. Submissive girl waits for punishment. Kinky lifestyle foto de Stock

- MJTV: What's A Torture Bra?

- For Sylvia Nasser, Exercise Was Once Punishment. Now, It's