10-year Treasury yield dips to new 2016 lows further below 2%

.1562153928810.png?w=929&h=523&vtcrop=y)

By A Mystery Man Writer

The yield on the benchmark 10-year Treasury note fell to its lowest level since November 2016 on Wednesday, continuing its slide below 2%.

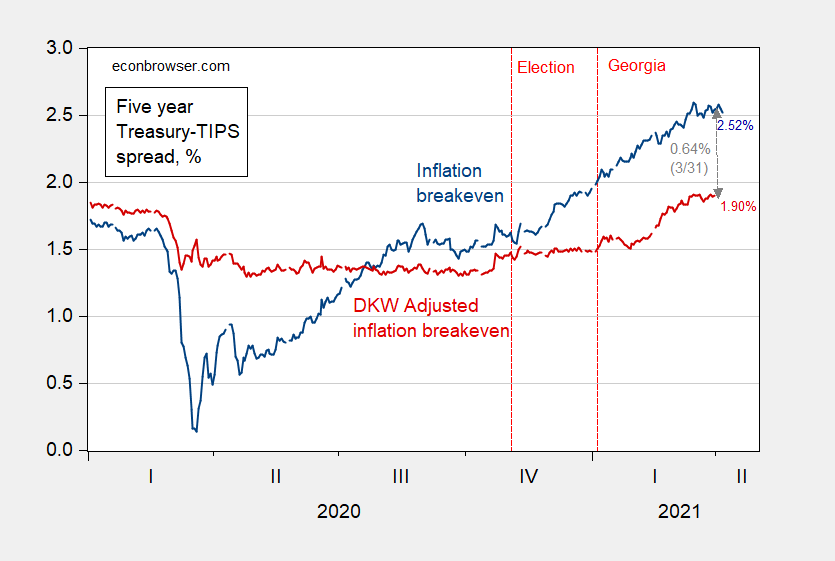

The Market's Expectations of Inflation and Real Rates over the Next Five Years

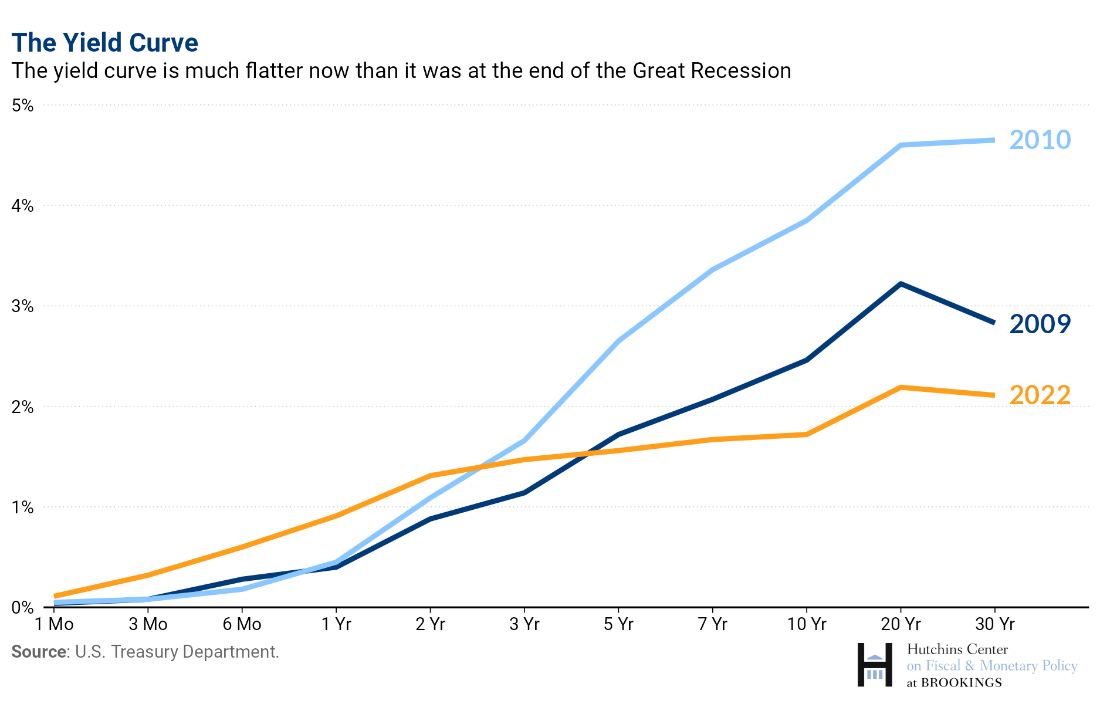

The Hutchins Center Explains: The yield curve - what it is, and why it matters

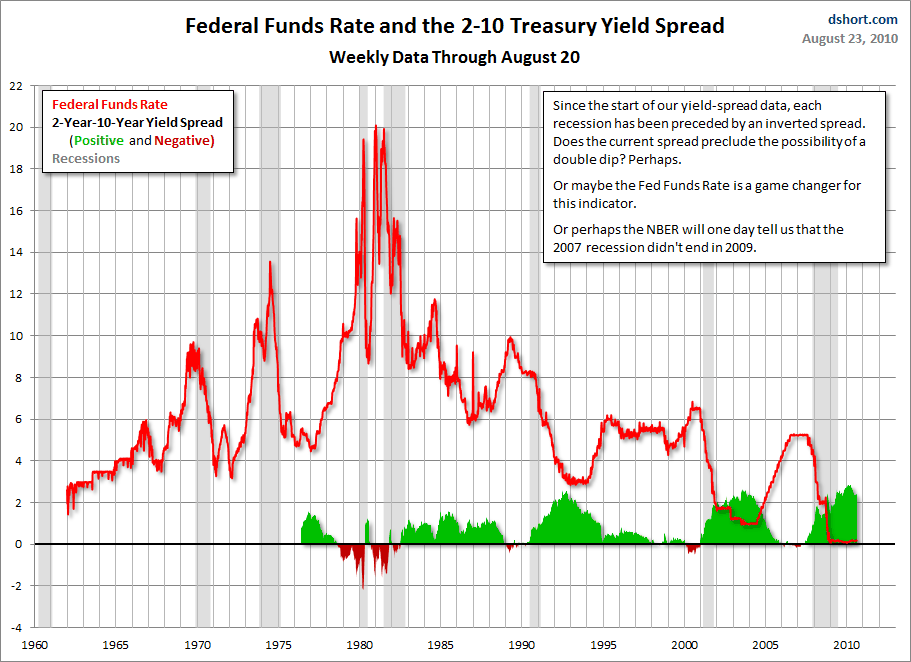

What the 2-10 Treasury Yield Spread Indicator Is Telling Us

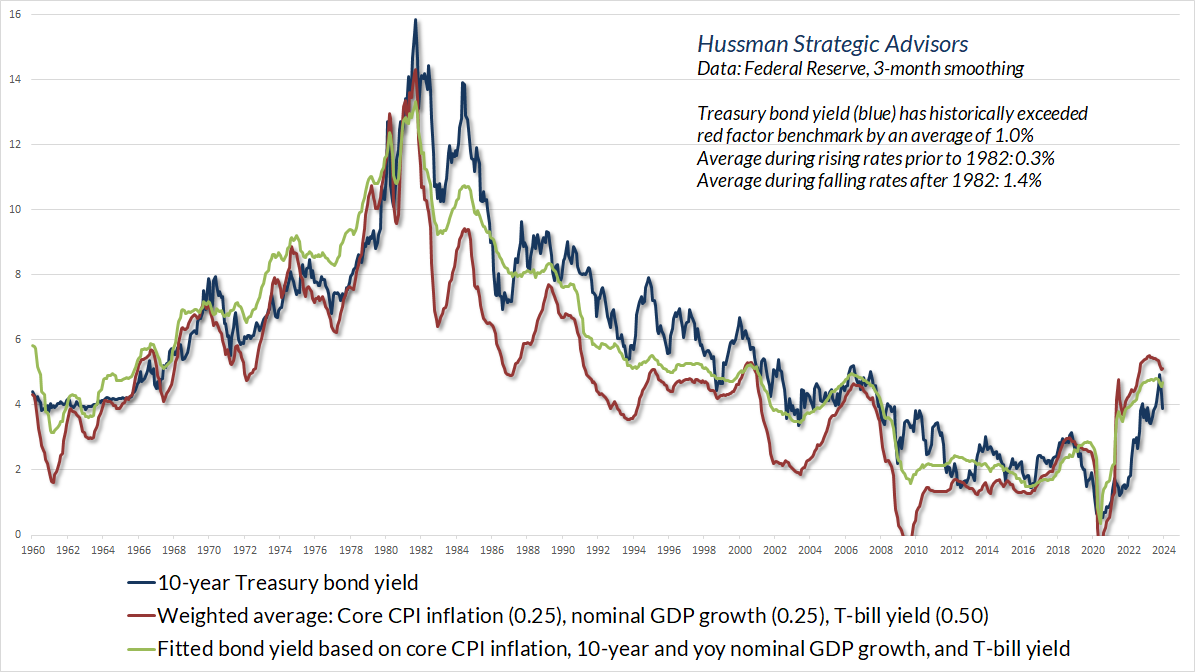

Higher for Longer Inflation & Interest Rates Not Over Until the Fat Lady Sings? Waiting for the 2-Year Treasury Yield to Overshoot

Weekly Market Commentary

The Return of Buy-Low Sell-High - Hussman Funds

Patrick Slater on LinkedIn: #yieldcurve #steepening #valuation #riskmanagement #assetallocation…

Treasury Bonds Plunge, Yields Spike amid Stock & Crypto Mess

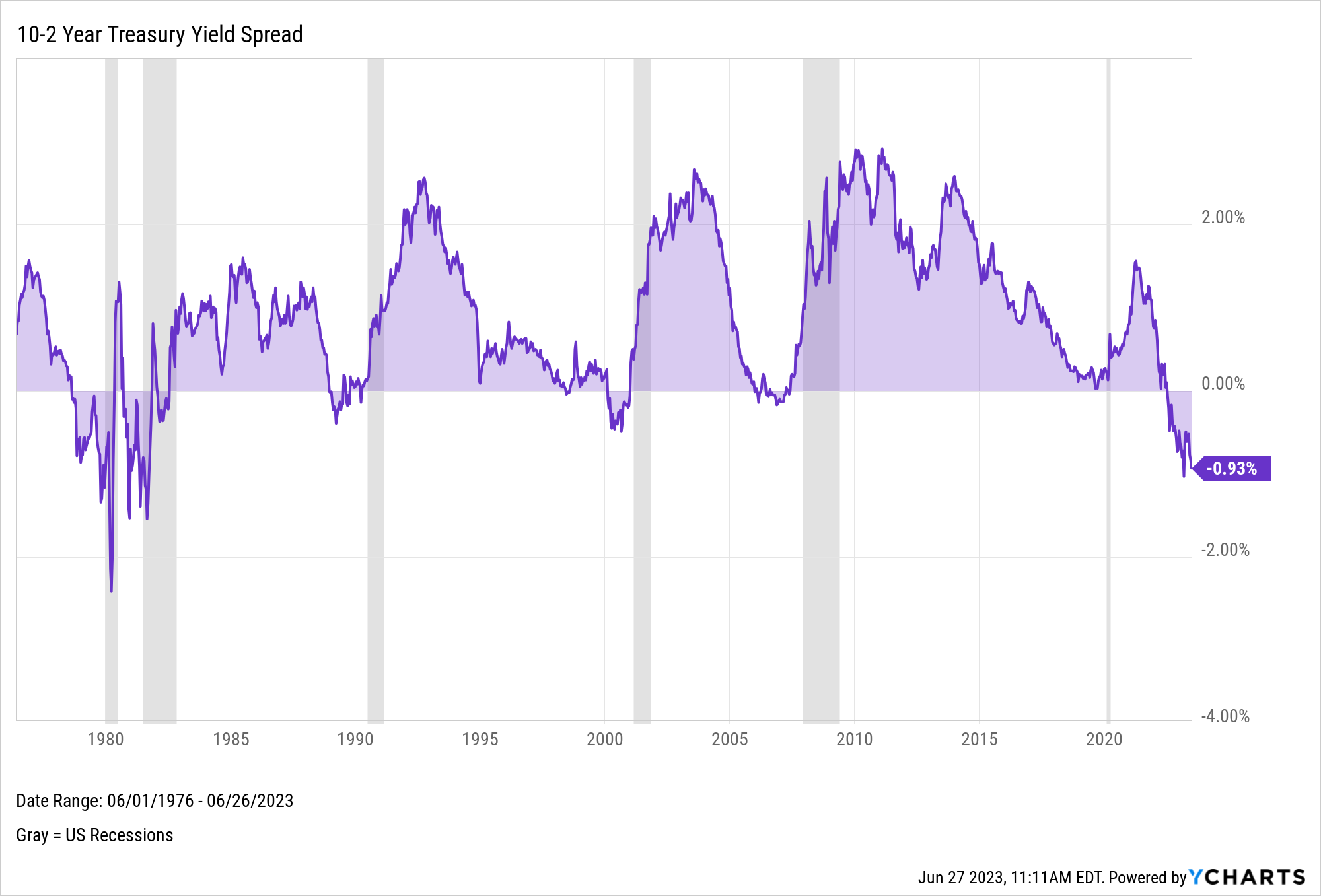

The Inverted Yield Curve: What It Means and How to Navigate It

The Daily Shot: The 30-Year Treasury Yield Dips Below 2% for the First Time - WSJ

For the first time, (1) the S&P 500 earnings yield (medium risk), (2) corporate bonds (low risk), and (3) treasury bills (no risk) are all offering the same yield, 5.3% This means

The Daily Shot: The 30-Year Treasury Yield Dips Below 2% for the First Time - WSJ

- Fruit of the Loom Men's White Briefs 100% Cotton Underwear 3 Pack

- Fleece Lined Tights for Women - Fake Translucent Warm Pantyhose Leggings Sheer Thick Tights for Winter

- Women's Mid-Rise Compression Tight Black/Dotted Black Logo - VO2

- Men's POLYPRO™ Base Layers Sport Apparel – ROOSTER USA

- MAX Washed Cropped Dungarees, Max, Avadi